ATO Client-to-Agent Linking Program

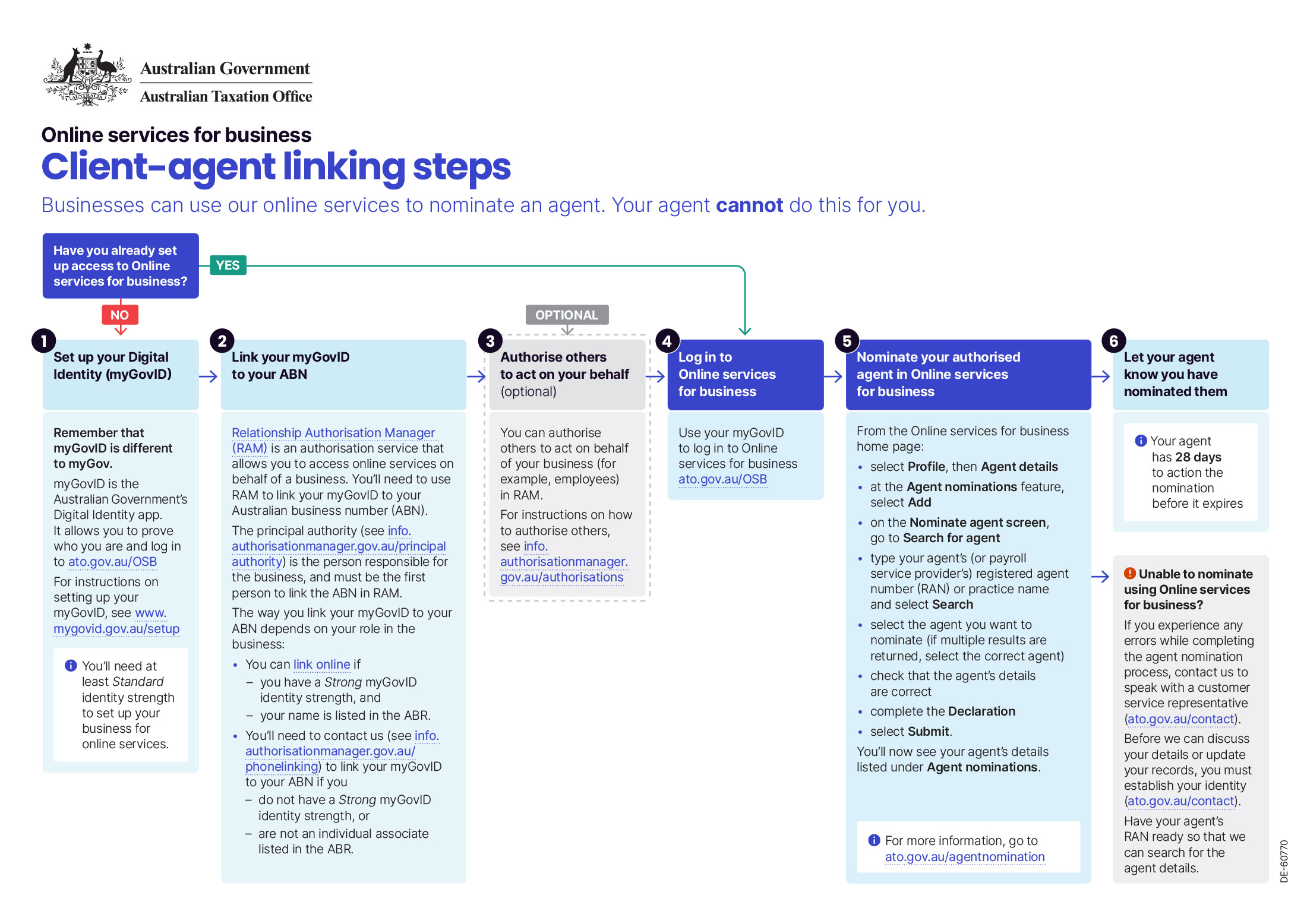

On 13 November 2023, the Australian Taxation Office rolled out the new “Client-to-agent linking in online services” program. This program is designed to strengthen security, and protect taxpayers and their agents against fraud and identity-related theft.

All taxpayers with an ABN, excluding sole traders, will need to nominate their tax agent before we can add them as a client with the ATO. Businesses can do this using the new “agent nomination” feature in Online Services for Business. Tax agents are not able to complete this on your behalf.

Please note that this process does not currently apply to individual taxpayers or sole traders.

The ATO has created detailed instructions to guide you through the process of linking your profile/s with our practice. These instructions can be found below.

Please note that existing clients linked to our practice are not required to complete this process, unless you are changing specific authorisations.

If you have any questions, require assistance, or wish to discuss further, please don’t hesitate to contact your dedicated Johnson Partners representative.